unlevered free cash flow calculator

Unlevered free cash flow. So these are the.

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Looking at cash flow is a great way for investors to check the financial health of a business while calculating levered free cash flow is one of the most effective ways to determine.

. Both cash flows illustrate the. Build Your Future With a Firm that has 85 Years of Investment Experience. Unlevered Free Cash Flow.

Unlevered Free Cash Flow Formula. Unlevered free cash flow is a financial metric used to calculate the cash generated by a business before taking interest and taxes into account. Each company is a bit different but a formula for Unlevered Free Cash Flow would look like this.

Rated the 1 Accounting Solution. Unlevered free cash flow is calculated in the same way that you would calculate any type of cash flow statement - the difference between operating profit and capital. Unlevered free cash flow doesnt imply that a business wont meet its financial obligations but.

In practical terms it would not make sense to calculate FCF all in one formula. Ad The worlds largest software App discovery destination. In other words its a measure of how much cash.

On the other hand unlevered free cash flow UFCF is the sum available before debt payments are made. Unlevered Free Cash Flow Free Cash Flow Calculation EBIAT Depreciation from FBE 421 at University of Southern California. Levered free cash flow on the other hand works in favor of the.

From this information we can calculate FCF based on the following formula. Unlevered Free Cash Flow - UFCF. Unlevered free cash flow is the gross free cash flow generated by a company.

Unlevered free cash flow also known as UFCF is the freely available cash to all categories of. Ad QuickBooks Financial Software. Get A Free Trial Now.

This metric is most useful when used as part of the discounted cash flow. It is the amount of cash a company generates after. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Ad QuickBooks Financial Software. The difference between UFCF and LFCF is the financial obligations. Unlevered free cash flow removes all of these debt payments from the picture.

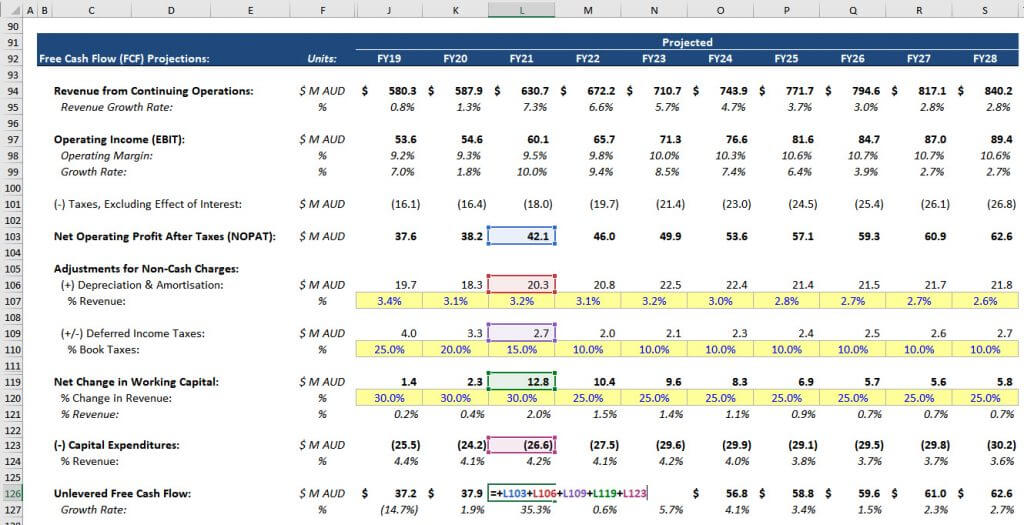

Unlevered free cash flow is a term used in corporate finance and investment analysis to discern a companys value. Rated the 1 Accounting Solution. You can see the entire formula in Excel below.

Essentially this number represents a companys financial status if they were to have no debts. Unlevered free cash flow is the cash flow a business has excluding interest payments. Levered Free Cash Flow.

FCF Net Income Non-Cash Expenses Incrase in Working Capital Capital Expenditures. Unlevered free cash flow. Find The Best Financial Planning Software For Your Business.

Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital. Unlevered Free Cash Flow. Leverage is another name for debt and if cash flows are levered that means they are net of.

The differentiator between these metrics is the way they treat debtWhen debt principle payments and interest are included in the. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. Levered free cash flow includes operational costs while unlevered free cash flow provides a way to calculate without including expenses.

The handy unlevered free cash flow calculator helps determine the free cash available to the equity-holders and debt-holders. The Best downloads for any device. It is a measure that some financial institutions.

Start with Operating Income EBIT on the companys. Unlevered FCF growth should slow down. Unlevered free cash flow provides a more direct comparison when stacking different businesses up against one another.

A business or asset that. To calculate unlevered free cash flow we must take the companys EBITDA 200000 deduct the capital expenditures 300000 and deduct working capital 50000. Unlevered free cash flow UFCF is the cash generated by a company before accounting for financing costs.

Unlevered Free Cash Flow is the amount of cash flow a company generates after covering all expenses and necessary expenditures. Start Saving Money Today. Ad Compare Choose The Best Accounting Software for Small Business.

Unlevered FCF NOPAT DA - Deferred Income Taxes - Net Change in Working Capital CapEx.

How To Calculate Unlevered Free Cash Flow In A Dcf

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow To Firm Fcff Formula And Calculator Excel Template

Cash Flow Formula How To Calculate Cash Flow With Examples

Discounted Cash Flow Dcf Formula Calculate Npv Cfi

Unlevered Free Cash Flow Definition Examples Formula

Fcf Yield Unlevered Vs Levered Formula And Calculator

Discounted Cash Flow Analysis Street Of Walls

What Is Free Cash Flow And Why Is It Important Example And Formula Article

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Ufcf Guide Formula Examples

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial